Transforming high-potential mineral assets into lasting value

Contact us to learn more about Opal

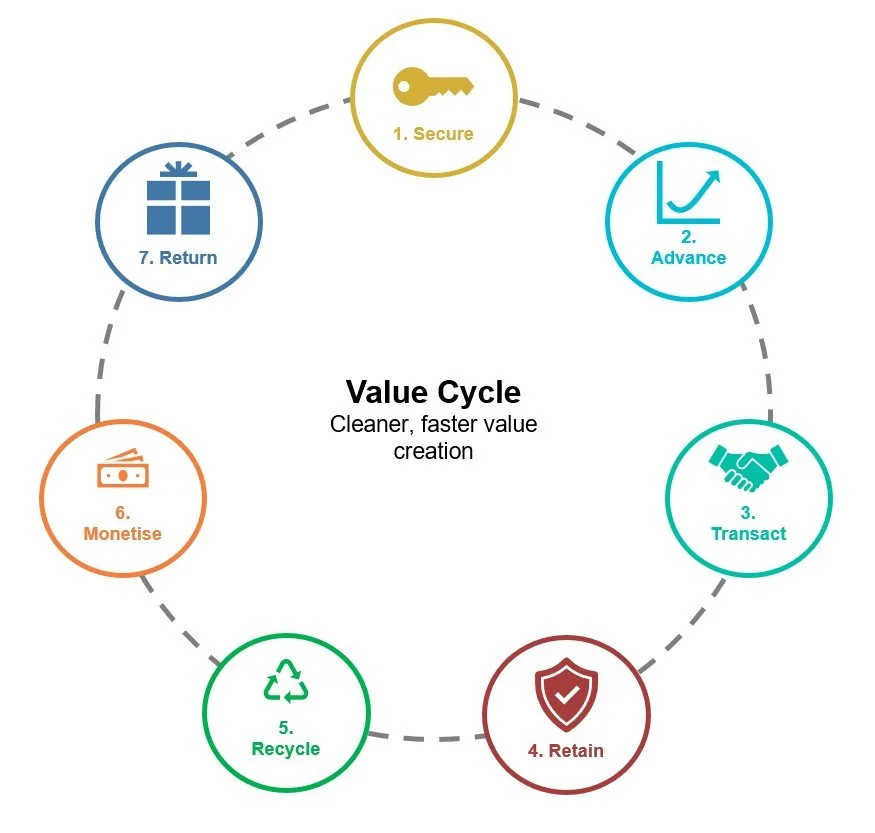

The Opal Model

Secure: Find and secure high-potential projects.

Advance: Add value with technical work, modeling and the identification of unrecognised targets.

Transact: Vend projects to ASX partners.

Retain: Retain ownership in the vehicle.

Recycle: Use cash proceeds to fund new opportunities.

Monetise: Monetise ownership in vehicle as value increases.

Return: Deliver dividends to shareholders whilst securing the next project.

Case Study: A Win-Win Transaction

How a ~$50,000 investment was transformed into a multi-million dollar opportunity, proving the power of the Opal Resources model.

The sale of our Olympus Scandium Project to Hawk Resources (ASX:HWK) is the first successful transaction under our new project generator and vendor model. It perfectly demonstrates our strategy of identifying undervalued assets, securing them on favorable terms, and structuring deals that deliver exceptional returns for our shareholders. Hawk’s ASX announcement can be seen here.

The Opportunity

The Olympus Project, one of the first assets Opal secured in 2024, hosts historical drill results with exceptionally high scandium grades, comparable to the world's leading deposits. After our due diligence, we determined that the best way to unlock its value was to partner with a larger, ASX-listed company that had the technical expertise and financial capacity to advance the project aggressively.

Hawk Resources, led by respected industry veteran Tom Eadie, saw the same potential and acquired an 80% interest in the project.

The Transaction

This deal was structured to provide Opal with immediate cash flow, significant exposure to exploration success through shares and options, and long-term upside via a retained interest and milestone payments.

For our initial investment of approximately $50,000, Opal has received a comprehensive package with potential outcomes ranging from a minimum of $250,000 to approx. $6.9 million - pending successful due diligence by Hawk.

Importantly, Opal also retained a 20% free-carried interest in the project all the way through to a Decision to Mine, giving our shareholders long-term exposure without any additional capital commitment.

The Outcome: A Repeatable Model for Success

The Olympus-Hawk transaction is a clear win for our shareholders. It validates our strategy to create value through smart, data-driven deal-making. It provides our company with non-dilutive funding to secure new opportunities while retaining significant, long-term upside in the projects we vend.

Do you have a project that could be a success story?